Select a fund to view frequently asked questions and information on each fund

GLOBAL

BALANCED

MI-PLAN IP SARASIN EQUISAR FEEDER FUND

A global equity fund ideal for investors seeking exposure to foreign markets

Who is the fund aimed at?

The Mi-Plan IP Sarasin Equisar Feeder fund is suitable for use by investors with a longer term investment horizon who are comfortable with shorter term volatility as well as the risk associated with a fund mandated to achieve real long term growth.

What are the investment objectives of the fund?

The objective of the Mi-Plan IP Sarasin Equisar Feeder fund is to offer investors the opportunity for offshore diversification and exposure to global equity markets. The objective of the underlying fund is to achieve long term capital growth through an internationally diversified portfolio of equities and other instruments.

What is a feeder fund?

A feeder fund invests directly into its underlying offshore fund. The client does not make use of their foreign exchange allowance.

What is the underlying fund?

The Sarasin IE Global Equity Opportunities Fund.

How does the manager select its stock?

In recognition of the limitations of geographically determined asset allocations in today’s global economy, the fund’s assets are allocated by global themes which track long term worldwide growth trends that are largely independent of any region or market. The fund then invests in companies that fit these themes.

Who are the fund managers?

Underlying Fund: Sarasin & Partners LLP

Feeder fund: MI-PLAN

What is the fund’s geographic allocation?

Can I invest in Rands or must I apply for foreign exchange allowance?

This fund is priced in Rands even though the investments in the fund are made on offshore markets.

Why should I invest now?

The fund allows investors to get exposure to foreign markets while investing in Rands. It should be noted that the South African Reserve bank limits collective investment scheme providers to invest no more than 40% of their retail assets under management in offshore markets. This may result in the fund closing for new investments in the future.

What are the fees?

The annual management fee of the fund is 0.75% (excl VAT).

For more details regarding the fees of this fund, please view the factsheet.

Where can I get a factsheet or a minimum disclosure document?

The factsheet can be obtained from the Mi-Plan website here

How can I access the fund?

The Mi-Plan IP Sarasin Equisar Feeder Fund is available on the ABSA Investment Management Services, Glacier, Ninety One (formerly Investec), Momentum and PSG platforms.

Furthermore, to invest directly, click here.

For discretionary investments, the fund has a minimum investment requirement of R10 000 lump sum or a minimum monthly payment of R1000.

For Tax Free Savings Accounts (TFSA), the fund has a minimum lump sum investment requirement of R10 000; maximum lump sum investment of R36 000 lump sum, or a minimum monthly payment of R1000; maximum monthly payment of R3000.

Fund performance

|

|

1 Year Return |

3 Year Return* |

5 Year Return* |

10 Year Return* |

|

MI-PLAN IP Sarasin Equisar Feeder Fund B5 |

11.65% |

8.7% |

14.02% |

10.8% |

|

Fund Quartile Rank |

4 |

3 |

4 |

3 |

|

ASISA – Global Equity General Sector Average |

19.18% |

9.81% |

15.14% |

11.24% |

|

|

Return |

|

Highest Annual Return (Rolling Maximum)** |

49.5% |

|

Lowest Annual Return (Rolling Lowest)** |

-17.4% |

Source: Morningstar; Performance as at 31 January 2024

* Returns are annualised if period is longer than 12 months. Based on B5 class.

Actual annual figures are available to the investor on request.

Annualised returns is the weighted average compound growth rate over the performance period measured. Fund returns shown are based on NAV-NAV unit pricings calclulated from Morningstar for a lumpsum investment with income distriubution reinvested (after fees and costs).

**The highest and lowest annual returns are based on rolling 1 year returns with 1 month steps.

For updated figures, please review the fund factsheet.

How do I contact Mi-Plan about the fund?

You can call us on 021 657 5960 or email info@miplan.co.za

Collective Investment Schemes are generally medium to long term investments. The value of participatory interests or the investment may go down as well as up. Past performance is not necessarily a guide to future performance. Collective investment schemes are traded at ruling prices and can engage in borrowing and scrip lending. A schedule of fees and charges and maximum commissions is available on request from the manager. Fund invest in portfolios of other Collective Investment Schemes that levy their own charges, which could result in a higher fee structure for the fund. The Manager does not provide any guarantee either with respect to the capital or the return of a portfolio. The Manager retains full legal responsibility for the Fund, regardless of Co-Naming arrangements. Transaction cut-off time is 14:30 daily. Each portfolio may be closed for new investments. Valuation time is 15:00 (17h00 at quarter end). Prices are published daily and available newspapers countrywide, as well as on request from the Manager. IP Management Company (RF) Pty Ltd is the authorised Manager of the Scheme – contact 021 673 1340 or clientservices@ipmc.co.za. Standard Bank is the trustee / custodian – contact compliance-IP@standardbank.co.za. Additional information including application forms, the annual report of the Manager and detailed holdings of the portfolio as at the last quarter end are available, free of charge, from clientservices@ipmc.co.za. IP Management Company is a member of ASISA. A statement of changes in the composition of the portfolio during the reporting period is available on request. The portfolio may include foreign investments and the following additional risks may apply: liquidity constraints when selling foreign investments and risk of non-settlement of trades; macroeconomic and political risks associated with the country in which the investment is made; risk of loss on foreign exchange transactions and investment valuation due to fluctuating exchange rates; risk of foreign tax being applicable; potential limitations on availability of market information which could affect the valuation and liquidity of an investment. All of these risks could affect the valuation of an investment in the fund.

For all disclosures please go to www.mi-plan.co.za/disclosure/.

If you would like to print this advert, please click here.

MI-PLAN IP GLOBAL AI OPPORUNITY FUND

A global equity fund ideal for investors seeking exposure to foreign markets

Who is the fund aimed at?

The Mi-Plan IP Global AI Opportunity fund is a fund suitable for investors:

- With a longer-term investment horizon who are comfortable with shorter term volatility and risk associated with a fund mandated to achieve long term capital growth.

What are the investment objectives of the fund?

The Mi-Plan IP Global AI Opportunity Fund is a global equity portfolio which aims to achieve long term capital growth by investing predominantly in foreign equity securities and participatory interests in collective investment schemes including exchange traded funds. In selecting securities, artificial intelligence based quantitative processes may be used to seek out opportunities.

What investment philosophy does Mi-Plan follow?

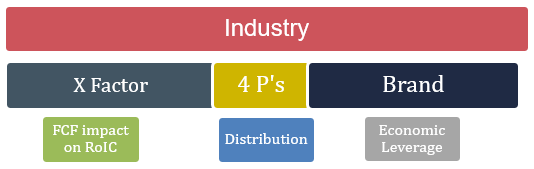

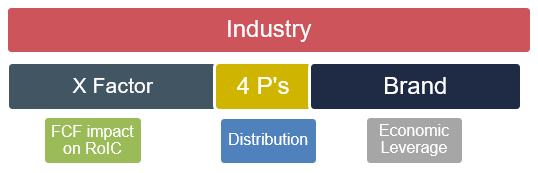

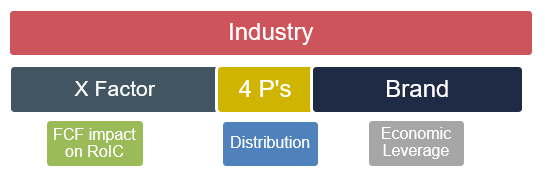

The fund follows a philosophy that alpha is generated from being able to assess the degree to which the rate of change in earnings growth differs from current consensus earnings estimates and is progressively discounted into each company’s share price. To assess this, the manager uses seven key inputs, namely: industry, X Factor, Brand, 4P’s (product, position, price, people), distribution, economic leverage and free cash flow impact on RoIC (return on invested capital). In reviewing each of these factors for each company, an understanding is arrived at that provides both a qualitative and quantitative assessment of how earnings growth rates may evolve. This approach, combined with some inference as to the market’s assessment of earnings growth prospects, completes the picture. Portfolio construction and drawdown risk management play a key role in the ultimate portfolio composition. Asset allocation and stock selection vary according to the manager’s macroeconomic view and the attractiveness of each asset class.

Who is the fund manager?

Tony Bell – Having started out as an accountant, Tony moved to Southern Life Asset Management and soon became assistant General Manager of Investments. His move to Syfrets Managed Assets created the opportunity for Tony to become Chief Investment Officer at Nedcor Investment Bank. As the former CIO of PeregrineQuant and Vunani Fund Managers (VFM), and more recently, the CIO of Thinkcell, Tony brings a wealth of experience especially in running the overall asset allocation of the fund. His MBA thesis “Portfolio Management an Alternative Approach” which was awarded with distinction reflects Tony’s interest in understanding how the macro environment affects markets and asset class returns.

Who is Mi-Plan?

Mi-Plan exists to create and preserve wealth through the application of critical thinking. Established in 2006, we assist our clients to manage their money to achieve their desired outcomes through understanding their future income objectives and then creating and managing the wealth required to meet those plans.

For more information about Mi-Plan visit: www.mi-plan.co.za

What is the fund’s risk profile and time horizon?

The fund is suitable for use by investors with a long-term investment horizon who are comfortable with shorter term volatility as well as the risk associated with a fund mandated to achieve real long-term growth. The fund is also suitable for investors as a part of their long-term growth assets as determined by their financial analysis

Why should I invest now?

The fund allows investors to get exposure to foreign markets while investing in Rands. It should be noted that the South African Reserve bank limits collective investment scheme providers to invest no more than 40% of their retail assets under management in offshore markets. This may result in the fund closing for new investments in the future.

What are the fees?

The annual management fee of the fund is 0.95% (excl VAT).

For more details regarding the fees of this fund, please view the factsheet.

Where can I get a factsheet or a minimum disclosure document?

The factsheet can be obtained from the Mi-Plan website here

How can I access the fund?

The Mi-Plan IP Global AI Opportunity Fund is available on the Glacier, Momentum and PSG platforms.

Furthermore, to invest directly, click here.

For discretionary investments, the fund has a minimum investment requirement of R10 000 lump sum or a minimum monthly payment of R1000.

For Tax Free Savings Accounts (TFSA), the fund has a minimum lump sum investment requirement of R10 000; maximum lump sum investment of R36 000 lump sum, or a minimum monthly payment of R1000; maximum monthly payment of R3000.

Fund performance

|

|

1 Year Return |

3 Year Return* |

Since Inception Return** |

|

MI-PLAN IP Global AI Opportunity Fund B2 |

33.03% |

14.36% |

13.04% |

|

Fund Quartile Rank |

1 |

2 |

1 |

|

ASISA – Global Equity General Sector Average |

19.18% |

9.81% |

10.18% |

|

|

Return |

|

Highest Annual Return (Rolling Maximum)*** |

39.5% |

|

Lowest Annual Return (Rolling Lowest)*** |

-13.5% |

Source: Morningstar; Performance as at 31 January 2024

* Returns are annualised if period is longer than 12 months. Based on B2 class.

** The fund was launched on 10 September 2018

Actual annual figures are available to the investor on request.

Annualised returns is the weighted average compound growth rate over the performance period measured. Fund returns shown are based on NAV-NAV unit pricings calclulated from Morningstar for a lumpsum investment with income distriubution reinvested (after fees and costs).

***The highest and lowest annual returns are based on rolling 1 year returns with 1 month steps.

For updated figures, please review the fund factsheet.

How do I contact Mi-Plan about the fund?

You can call us on 021 657 5960 or email info@miplan.co.za

Collective Investment Schemes are generally medium to long term investments. The value of participatory interests or the investment may go down as well as up. Past performance is not necessarily a guide to future performance. Collective investment schemes are traded at ruling prices and can engage in borrowing and scrip lending. A schedule of fees and charges and maximum commissions is available on request from the manager. Fund invest in portfolios of other Collective Investment Schemes that levy their own charges, which could result in a higher fee structure for the fund. The Manager does not provide any guarantee either with respect to the capital or the return of a portfolio. The Manager retains full legal responsibility for the Fund, regardless of Co-Naming arrangements. Transaction cut-off time is 14:30 daily. Each portfolio may be closed for new investments. Valuation time is 15:00 (17h00 at quarter end). Prices are published daily and available newspapers countrywide, as well as on request from the Manager. IP Management Company (RF) Pty Ltd is the authorised Manager of the Scheme – contact 021 673 1340 or clientservices@ipmc.co.za. Standard Bank is the trustee / custodian – contact compliance-IP@standardbank.co.za. Additional information including application forms, the annual report of the Manager and detailed holdings of the portfolio as at the last quarter end are available, free of charge, from clientservices@ipmc.co.za. IP Management Company is a member of ASISA. A statement of changes in the composition of the portfolio during the reporting period is available on request. The portfolio may include foreign investments and the following additional risks may apply: liquidity constraints when selling foreign investments and risk of non-settlement of trades; macroeconomic and political risks associated with the country in which the investment is made; risk of loss on foreign exchange transactions and investment valuation due to fluctuating exchange rates; risk of foreign tax being applicable; potential limitations on availability of market information which could affect the valuation and liquidity of an investment. All of these risks could affect the valuation of an investment in the fund.

For all disclosures please go to www.mi-plan.co.za/disclosure/

If you would like to print this advert, please click here.

MI-PLAN IP GLOBAL MACRO FUND

A global multi-asset flexible fund ideal for investors wanting exposure to foreign markets and are comfortable with short-term volatility.

Who is the fund aimed at?

The Mi-Plan IP Global Macro fund is a global multi-asset flexible fund suitable for investors:

- With a longer term investment horizon who are comfortable with shorter term volatility and risk associated with a fund mandated to achieve long term capital growth.

- As part of their long term growth assets as determined by their financial analysis.

- Seeking actively managed exposure to global equity opportunities whilst seeking to mitigate downside risk that undermines the long term growth objective.

What are the investment objectives of the fund?

Mi-Plan IP Global Macro fund’s objective is to achieve capital appreciation over the medium to long term. There will be no limitations on the relative exposure of the portfolio to any asset class.

What does the fund invest in?

The Mi-Plan IP Global Macro Fund is a global multi-asset flexible fund, investing primarily in foreign markets and can invest in equities, fixed interest and cash.

What investment philosophy does Mi-Plan follow?

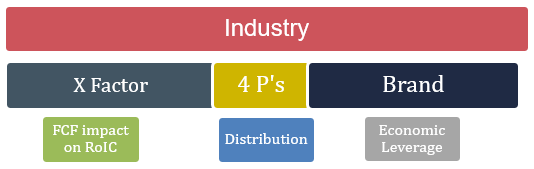

The fund follows a philosophy that alpha is generated from being able to assess the degree to which the rate of change in earnings growth differs from current consensus earnings estimates and is progressively discounted into each company’s share price. To assess this, the manager uses seven key inputs, namely: industry, X Factor, Brand, 4P’s (product, position, price, people), distribution, economic leverage and free cash flow impact on RoIC (return on invested capital). In reviewing each of these factors for each company, an understanding is arrived at that provides both a qualitative and quantitative assessment of how earnings growth rates may evolve. This approach, combined with some inference as to the market’s assessment of earnings growth prospects, completes the picture. Portfolio construction and drawdown risk management play a key role in the ultimate portfolio composition. Asset allocation and stock selection vary according to the manager’s macroeconomic view and the attractiveness of each asset class.

Is the fund always fully invested?

No. The benefit of a flexible fund is that the fund manager does not have to invest 100% of the fund in equities if the manager feels other asset classes are more suitable.

Who is the fund manager?

Having started out as an accountant, Tony moved to Southern Life Asset Management and soon became assistant General Manager of Investments. His move to Syfrets Managed Assets created the opportunity for Tony to become Chief Investment Officer at Nedcor Investment Bank. As the former CIO of PeregrineQuant and Vunani Fund Managers (VFM), and more recently, the CIO of ThinkCell, Tony brings a wealth of experience especially in running the overall asset allocation of the fund. His MBA thesis “Portfolio Management an Alternative Approach” which was awarded with distinction reflects Tony’s interest in understanding how the macro environment affects markets and asset class returns.

Who is Mi-Plan?

Mi-Plan exists to create and preserve wealth through the application of critical thinking. Established in 2006, we assist our clients to manage their money to achieve their desired outcomes through understanding their future income objectives and then creating and managing the wealth required to meet those plans.

For more information about Mi-Plan visit: www.mi-plan.co.za

What is the fund’s risk profile and time horizon?

The fund is suitable for use by investors with a long-term investment horizon who are comfortable with shorter term volatility as well as the risk associated with a fund mandated to achieve real long-term growth. The fund is also suitable for investors as a part of their long-term growth assets as determined by their financial analysis. Also, investors who seek actively managed exposure to global equity opportunities whilst seeking to mitigate downside risk that undermines the long-term growth objective.

Why should I invest now?

The fund allows investors to get exposure to foreign markets while investing in Rands. It should be noted that the South African Reserve bank limits collective investment scheme providers to invest no more than 40% of their retail assets under management in offshore markets. This may result in the fund closing for new investments in the future.

What are the fees?

The annual management fee for the fund is 1% (excl. VAT).

For more details regarding the fees of this fund, please view the factsheet.

Where can I get a factsheet or a minimum disclosure document?

The factsheet can be obtained from the MiPlan website.

How can I access the fund?

The Mi-Plan IP Global Macro Fund is available on the ABSA Investment Management Services, Allan Gray, Glacier, Ninety One (formerly Investec), Momentum, Old Mutual, PPS, Wealthport and Stanlib platforms.

Furthermore, to invest directly, click here.

For discretionary investments, the fund has a minimum investment requirement of R10 000 lump sum or a minimum monthly payment of R1000.

For Tax Free Savings Accounts (TFSA), the fund has a minimum lump sum investment requirement of R10 000; maximum lump sum investment of R36 000 lump sum, or a minimum monthly payment of R1000; maximum monthly payment of R3000.

How good is the performance?

|

|

1 Year Return |

3 Year Return* |

5 Year Return* |

10 Year Return* |

|

MI-PLAN IP Global Macro Fund B5 |

32.89% |

13.92% |

17.92% |

14.66% |

|

Fund Quartile Rank |

1 |

1 |

1 |

1 |

|

ASISA – Global Multi Asset Flexible Sector Average |

14.2% |

8.27% |

11.76% |

8.78% |

|

Return |

|

|

Highest Annual Return (Rolling Maximum)** |

39.8% |

|

Lowest Annual Return (Rolling Lowest)** |

-14.2% |

Source: Morningstar, Performance as at 31 January 2024

* Returns are annualised if period is longer than 12 months. Based on B5 class.

Actual annual figures are available to the investor on request.

Annualised returns is the weighted average compound growth rate over the performance period measured. Fund returns shown are based on NAV-NAV unit pricings calculated from Morningstar for a lumpsum investment with income distribution reinvested (after fees and costs).

**The highest and lowest annual returns are based on rolling 1 year returns with 1 month steps.

For updated figures, please review the fund factsheet.

How do I contact Mi-Plan about the fund?

You can call us on 021 657 5960 or email info@miplan.co.za

Collective Investment Schemes are generally medium to long term investments. The value of participatory interests or the investment may go down as well as up. Past performance is not necessarily a guide to future performance. Collective investment schemes are traded at ruling prices and can engage in borrowing and scrip lending. A schedule of fees and charges and maximum commissions is available on request from the manager. Fund invest in portfolios of other Collective Investment Schemes that levy their own charges, which could result in a higher fee structure for the fund. The Manager does not provide any guarantee either with respect to the capital or the return of a portfolio. The Manager retains full legal responsibility for the Fund, regardless of Co-Naming arrangements. Transaction cut-off time is 14:30 daily. Each portfolio may be closed for new investments. Valuation time is 15:00 (17h00 at quarter end). Prices are published daily and available newspapers countrywide, as well as on request from the Manager. IP Management Company (RF) Pty Ltd is the authorised Manager of the Scheme – contact 021 673 1340 or clientservices@ipmc.co.za. Standard Bank is the trustee / custodian – contact compliance-IP@standardbank.co.za. Additional information including application forms, the annual report of the Manager and detailed holdings of the portfolio as at the last quarter end are available, free of charge, from clientservices@ipmc.co.za. IP Management Company is a member of ASISA. A statement of changes in the composition of the portfolio during the reporting period is available on request. The portfolio may include foreign investments and the following additional risks may apply: liquidity constraints when selling foreign investments and risk of non-settlement of trades; macroeconomic and political risks associated with the country in which the investment is made; risk of loss on foreign exchange transactions and investment valuation due to fluctuating exchange rates; risk of foreign tax being applicable; potential limitations on availability of market information which could affect the valuation and liquidity of an investment. All of these risks could affect the valuation of an investment in the fund.

For all disclosures please go to: www.mi-plan.co.za/disclosure/

If you would like to print this advert, please click here.

GLOBAL IP OPPORTUNITY FUND

A global multi-asset flexible fund ideal for investors wanting exposure to foreign markets and are comfortable with short-term volatility.

Who is the fund aimed at?

The Global IP Opportunity fund is a global multi-asset flexible fund suitable for investors:

- With a longer-term investment horizon who are comfortable with shorter term volatility and risk associated with a fund mandated to achieve long term capital growth.

- As part of their long-term growth assets as determined by their financial analysis.

- Seeking actively managed exposure to global equity opportunities whilst seeking to mitigate downside risk that undermines the long-term growth objective.

What are the investment objectives of the fund?

The Global IP Opportunity fund’s objective is to achieve capital appreciation over the medium to long term. There will be no limitations on the relative exposure of the portfolio to any asset class.

What does the fund invest in?

The Global IP Opportunity fund is a global multi-asset flexible fund, investing primarily in foreign markets and can invest in equities, fixed interest and cash.

What investment philosophy does Mi-Plan follow?

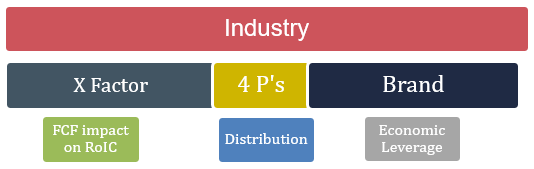

The fund follows a philosophy that alpha is generated from being able to assess the degree to which the rate of change in earnings growth differs from current consensus earnings estimates and is progressively discounted into each company’s share price. To assess this, the manager uses seven key inputs, namely: industry, X Factor, Brand, 4P’s (product, position, price, people), distribution, economic leverage and free cash flow impact on RoIC (return on invested capital). In reviewing each of these factors for each company, an understanding is arrived at that provides both a qualitative and quantitative assessment of how earnings growth rates may evolve. This approach, combined with some inference as to the market’s assessment of earnings growth prospects, completes the picture. Portfolio construction and drawdown risk management play a key role in the ultimate portfolio composition. Asset allocation and stock selection vary according to the manager’s macroeconomic view and the attractiveness of each asset class.

Is the fund always fully invested?

No. The benefit of a flexible fund is that the fund manager does not have to invest 100% of the fund in equities if the manager feels other asset classes are more suitable.

Who is the fund manager?

Having started out as an accountant, Tony moved to Southern Life Asset Management and soon became assistant General Manager of Investments. His move to Syfrets Managed Assets created the opportunity for Tony to become Chief Investment Officer at Nedcor Investment Bank. As the former CIO of PeregrineQuant and Vunani Fund Managers (VFM), and more recently, the CIO of Thinkcell, Tony brings a wealth of experience especially in running the overall asset allocation of the fund. His MBA thesis “Portfolio Management an Alternative Approach” which was awarded with distinction reflects Tony’s interest in understanding how the macro environment affects markets and asset class returns.

Who is Mi-Plan?

Mi-Plan exists to create and preserve wealth through the application of critical thinking. Established in 2006, we assist our clients to manage their money to achieve their desired outcomes through understanding their future income objectives and then creating and managing the wealth required to meet those plans.

For more information about Mi-Plan visit: www.mi-plan.co.za

What is the fund’s risk profile and time horizon?

The fund is suitable for use by investors with a long-term investment horizon who are comfortable with shorter term volatility as well as the risk associated with a fund mandated to achieve real long-term growth. The fund is also suitable for investors as a part of their long-term growth assets as determined by their financial analysis. Also, investors who seek actively managed exposure to global equity opportunities whilst seeking to mitigate downside risk that undermines the long-term growth objective.

Why should I invest now?

The fund allows investors to get exposure to foreign markets while investing in Rands. It should be noted that the South African Reserve bank limits collective investment scheme providers to invest no more than 40% of their retail assets under management in offshore markets. This may result in the fund closing for new investments in the future.

What are the fees?

Class B5 | Retail Class: The annual management fee is 0.95% (excl. VAT). This fund charges a performance fee (applicable to the B5 class only).

Performance Fee example: 20% outperformance of portfolio benchmark on a high water mark** basis over a rolling 12 month period, capped at 0.55%, plus VAT. If the fund underperforms the fee hurdle, then no fee is accrued until the high water mark is reached again.

*The distributor receives 0.4% from the management fee and 20% of any performance fees.

**The highest level of relative outperformance of the fund over the Fee Hurdle over a rolling 12 month period, calculated daily.

Distributor: Brenthurst Capital (2014/13019/07) Registered FSP No. 45921

Class C | Tax-free Class: The annual management fee for the fund is 1% (excl. VAT).

For more details regarding the fees of this fund, please view the factsheet.

Where can I get a factsheet or a minimum disclosure document?

The factsheet can be obtained from the MiPlan website.

How can I access the fund?

The Global IP Opportunity fund is available on the Allan Gray, Glacier, Global Nominees, Ninety One (formerly Investec), Momentum, Stanlib, Sygnia and Wealth Foundry platforms.

Furthermore, to invest directly, click here.

For discretionary investments, the fund has a minimum investment requirement of R10 000 lump sum or a minimum monthly payment of R1000.

For Tax Free Savings Accounts (TFSA), the fund has a minimum lump sum investment requirement of R10 000; maximum lump sum investment of R36 000 lump sum, or a minimum monthly payment of R1000; maximum monthly payment of R3000.

How good is the performance?

|

|

1 Year Return |

3 Year Return* |

5 Year Return* |

Since Inception Return** |

|

Global IP Opportunity Fund B5 |

31.17% |

13.1% |

17.38% |

14.21% |

|

Fund Quartile Rank |

1 |

1 |

1 |

1 |

|

ASISA – Global Multi Asset Flexible Sector Average |

14.20% |

8.27% |

11.76% |

9.07% |

|

Return |

|

|

Highest Annual Return (Rolling Maximum)*** |

38.4% |

|

Lowest Annual Return (Rolling Lowest)*** |

-15.8% |

Source: Morningstar, Performance as at 31 January 2023

* Returns are annualised if period is longer than 12 months. Based on B5 class.

**The fund was launched on 4 February 2014.

Actual annual figures are available to the investor on request.

Annualised returns is the weighted average compound growth rate over the performance period measured. Fund returns shown are based on NAV-NAV unit pricings calculated from Morningstar for a lumpsum investment with income distribution reinvested (after fees and costs).

***The highest and lowest annual returns are based on rolling 1 year returns with 1 month steps.

For updated figures, please review the fund factsheet.

How do I contact Mi-Plan about the fund?

You can call us on 021 657 5960 or email info@miplan.co.za

Collective Investment Schemes are generally medium to long term investments. The value of participatory interests or the investment may go down as well as up. Past performance is not necessarily a guide to future performance. Collective investment schemes are traded at ruling prices and can engage in borrowing and scrip lending. A schedule of fees and charges and maximum commissions is available on request from the manager. Fund invest in portfolios of other Collective Investment Schemes that levy their own charges, which could result in a higher fee structure for the fund. The Manager does not provide any guarantee either with respect to the capital or the return of a portfolio. The Manager retains full legal responsibility for the Fund, regardless of Co-Naming arrangements. Transaction cut-off time is 14:30 daily. Each portfolio may be closed for new investments. Valuation time is 15:00 (17h00 at quarter end). Prices are published daily and available newspapers countrywide, as well as on request from the Manager. IP Management Company (RF) Pty Ltd is the authorised Manager of the Scheme – contact 021 673 1340 or clientservices@ipmc.co.za. Standard Bank is the trustee / custodian – contact compliance-IP@standardbank.co.za. Additional information including application forms, the annual report of the Manager and detailed holdings of the portfolio as at the last quarter end are available, free of charge, from clientservices@ipmc.co.za. IP Management Company is a member of ASISA. A statement of changes in the composition of the portfolio during the reporting period is available on request. The portfolio may include foreign investments and the following additional risks may apply: liquidity constraints when selling foreign investments and risk of non-settlement of trades; macroeconomic and political risks associated with the country in which the investment is made; risk of loss on foreign exchange transactions and investment valuation due to fluctuating exchange rates; risk of foreign tax being applicable; potential limitations on availability of market information which could affect the valuation and liquidity of an investment. All of these risks could affect the valuation of an investment in the fund.

For all disclosures please go to: www.mi-plan.co.za/disclosure/

If you would like to print this advert, please click here.

GLOBAL MARATHON IP FUND

A global multi-asset flexible fund ideal for investors wanting exposure to foreign markets and are comfortable with short-term volatility.

Who is the fund aimed at?

The Global Marathon IP fund is a global multi-asset flexible fund suitable for investors:

- With a longer-term investment horizon who are comfortable with shorter term volatility and risk associated with a fund mandated to achieve long term capital growth.

- As part of their long-term growth assets as determined by their financial analysis.

- Seeking actively managed exposure to global equity opportunities whilst seeking to mitigate downside risk that undermines the long-term growth objective.

What are the investment objectives of the fund?

The Global Marathon IP fund’s objective is to achieve capital appreciation over the medium to long term. There will be no limitations on the relative exposure of the portfolio to any asset class.

What does the fund invest in?

The Global Marathon IP fund is a global multi-asset flexible fund, investing primarily in foreign markets and can invest in equities, fixed interest, property and cash.

What investment philosophy does Mi-Plan follow?

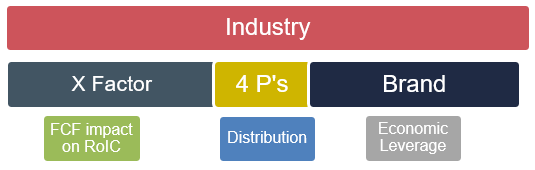

The fund follows a philosophy that alpha is generated from being able to assess the degree to which the rate of change in earnings growth differs from current consensus earnings estimates and is progressively discounted into each company’s share price. To assess this, the manager uses seven key inputs, namely: industry, X Factor, Brand, 4P’s (product, position, price, people), distribution, economic leverage and free cash flow impact on RoIC (return on invested capital). In reviewing each of these factors for each company, an understanding is arrived at that provides both a qualitative and quantitative assessment of how earnings growth rates may evolve. This approach, combined with some inference as to the market’s assessment of earnings growth prospects, completes the picture. Portfolio construction and drawdown risk management play a key role in the ultimate portfolio composition. Asset allocation and stock selection vary according to the manager’s macroeconomic view and the attractiveness of each asset class.

Is the fund always fully invested?

No. The benefit of a flexible fund is that the fund manager does not have to invest 100% of the fund in equities if the manager feels other asset classes are more suitable.

Who is the fund manager?

Having started out as an accountant, Tony moved to Southern Life Asset Management and soon became assistant General Manager of Investments. His move to Syfrets Managed Assets created the opportunity for Tony to become Chief Investment Officer at Nedcor Investment Bank. As the former CIO of PeregrineQuant and Vunani Fund Managers (VFM), and more recently, the CIO of Thinkcell, Tony brings a wealth of experience especially in running the overall asset allocation of the fund. His MBA thesis “Portfolio Management an Alternative Approach” which was awarded with distinction reflects Tony’s interest in understanding how the macro environment affects markets and asset class returns.

Who is Mi-Plan?

Mi-Plan exists to create and preserve wealth through the application of critical thinking. Established in 2006, we assist our clients to manage their money to achieve their desired outcomes through understanding their future income objectives and then creating and managing the wealth required to meet those plans.

For more information about Mi-Plan visit: www.mi-plan.co.za

What is the fund’s risk profile and time horizon?

The fund is suitable for use by investors with a long-term investment horizon who are comfortable with shorter term volatility as well as the risk associated with a fund mandated to achieve real long-term growth. The fund is also suitable for investors as a part of their long-term growth assets as determined by their financial analysis. Also, investors who seek actively managed exposure to global equity opportunities whilst seeking to mitigate downside risk that undermines the long-term growth objective.

Why should I invest now?

The fund allows investors to get exposure to foreign markets while investing in Rands. It should be noted that the South African Reserve bank limits collective investment scheme providers to invest no more than 40% of their retail assets under management in offshore markets. This may result in the fund closing for new investments in the future.

What are the fees?

The annual management fee is 0.70% (excl. VAT).

For more details regarding the fees of this fund, please view the factsheet.

Where can I get a factsheet or a minimum disclosure document?

The factsheet can be obtained from the MiPlan website.

How can I access the fund?

The Global Marathon IP fund is available on the Glacier, Global Nominees and Ninety One (formerly Investec) platforms.

Furthermore, to invest directly, click here.

For discretionary investments, the fund has a minimum investment requirement of R10 000 lump sum or a minimum monthly payment of R1000.

For Tax Free Savings Accounts (TFSA), the fund has a minimum lump sum investment requirement of R10 000; maximum lump sum investment of R36 000 lump sum, or a minimum monthly payment of R1000; maximum monthly payment of R3000.

How good is the performance?

|

|

1 Year Return |

3 Year Return* |

5 Year Return* |

Since Inception Return** |

|

Global Marathon IP Fund A1 |

33.29% |

14.32% |

18.72% |

14.92% |

|

Fund Quartile Rank |

1 |

1 |

1 |

1 |

|

ASISA – Global Multi Asset Flexible Sector Average |

14.2% |

8.27% |

11.76% |

8.71% |

|

Return |

|

|

Highest Annual Return (Rolling Maximum)*** |

36.1% |

|

Lowest Annual Return (Rolling Lowest)*** |

-13.9% |

Source: Morningstar, Performance as at 31 January 2024

* Returns are annualised if period is longer than 12 months. Based on A1class.

**The fund was launched on 16 October 2015.

Actual annual figures are available to the investor on request.

Annualised returns is the weighted average compound growth rate over the performance period measured. Fund returns shown are based on NAV-NAV unit pricings calculated from Morningstar for a lumpsum investment with income distribution reinvested (after fees and costs).

***The highest and lowest annual returns are based on rolling 1 year returns with 1 month steps.

For updated figures, please review the fund factsheet.

How do I contact Mi-Plan about the fund?

You can call us on 021 657 5960 or email info@miplan.co.za

Collective Investment Schemes are generally medium to long term investments. The value of participatory interests or the investment may go down as well as up. Past performance is not necessarily a guide to future performance. Collective investment schemes are traded at ruling prices and can engage in borrowing and scrip lending. A schedule of fees and charges and maximum commissions is available on request from the manager. Fund invest in portfolios of other Collective Investment Schemes that levy their own charges, which could result in a higher fee structure for the fund. The Manager does not provide any guarantee either with respect to the capital or the return of a portfolio. The Manager retains full legal responsibility for the Fund, regardless of Co-Naming arrangements. Transaction cut-off time is 14:30 daily. Each portfolio may be closed for new investments. Valuation time is 15:00 (17h00 at quarter end). Prices are published daily and available newspapers countrywide, as well as on request from the Manager. IP Management Company (RF) Pty Ltd is the authorised Manager of the Scheme – contact 021 673 1340 or clientservices@ipmc.co.za. Standard Bank is the trustee / custodian – contact compliance-IP@standardbank.co.za. Additional information including application forms, the annual report of the Manager and detailed holdings of the portfolio as at the last quarter end are available, free of charge, from clientservices@ipmc.co.za. IP Management Company is a member of ASISA. A statement of changes in the composition of the portfolio during the reporting period is available on request. The portfolio may include foreign investments and the following additional risks may apply: liquidity constraints when selling foreign investments and risk of non-settlement of trades; macroeconomic and political risks associated with the country in which the investment is made; risk of loss on foreign exchange transactions and investment valuation due to fluctuating exchange rates; risk of foreign tax being applicable; potential limitations on availability of market information which could affect the valuation and liquidity of an investment. All of these risks could affect the valuation of an investment in the fund.

For all disclosures please go to: www.mi-plan.co.za/disclosure/

If you would like to print this advert, please click here.

…

Collective Investment Schemes are generally medium to long term investments. The value of participatory interests or the investment may go down as well as up. Past performance is not necessarily a guide to future performance. Collective investment schemes are traded at ruling prices and can engage in borrowing and scrip lending. A schedule of fees and charges and maximum commissions is available on request from the manager. Fund invest in portfolios of other Collective Investment Schemes that levy their own charges, which could result in a higher fee structure for the fund. The Manager does not provide any guarantee either with respect to the capital or the return of a portfolio. The Manager retains full legal responsibility for the Fund, regardless of Co-Naming arrangements. Transaction cut-off time is 14:30 daily. Each portfolio may be closed for new investments. Valuation time is 15:00 (17h00 at quarter end). Prices are published daily and available newspapers countrywide, as well as on request from the Manager. IP Management Company (RF) Pty Ltd is the authorised Manager of the Scheme – contact 021 673 1340 or clientservices@ipmc.co.za. Standard Bank is the trustee / custodian – contact compliance-IP@standardbank.co.za. Additional information including application forms, the annual report of the Manager and detailed holdings of the portfolio as at the last quarter end are available, free of charge, from clientservices@ipmc.co.za. IP Management Company is a member of ASISA. A statement of changes in the composition of the portfolio during the reporting period is available on request. The portfolio may include foreign investments and the following additional risks may apply: liquidity constraints when selling foreign investments and risk of non-settlement of trades; macroeconomic and political risks associated with the country in which the investment is made; risk of loss on foreign exchange transactions and investment valuation due to fluctuating exchange rates; risk of foreign tax being applicable; potential limitations on availability of market information which could affect the valuation and liquidity of an investment. All of these risks could affect the valuation of an investment in the fund.

For all disclosures, please go to www.mi-plan.co.za/disclosure/

MI-PLAN IP BALANCED DEFENSIVE FUND

A low-equity fund ideal for low-risk investors requiring a growing regular income

Who is the fund aimed at?

The Mi-Plan IP Balanced Defensive fund is regulation 28 compliant fund and is aimed at retirees who are ideally looking for a multi-asset strategy with diversified exposure to both, local and foreign asset classes with the following risk profiles and time horizons in mind:

| FUND | RISK PROFILE | MINIMUM TIME HORIZON |

| Mi-Plan IP Balanced Defensive Fund | Conservative | 2-3 years |

Effective 24 January 2024, the following changes were made to the fund:

- Name change from Mi-Plan IP Inflation Plus 3 fund to Mi-Plan IP Balanced Defensive fund.

- Benchmark change from CPI +3% to the ASISA – South African Multi Asset Low Equity sector average.

What are the investment objectives of the fund?

The fund aims to achieve stable capital appreciation with low volatility.

What does the fund invest in?

The fund invests in a mix of domestic and foreign asset classes, namely equities, fixed interest and cash. The fund complies with Regulation 28 limits and ASISA limits and are subject to a maximum of 40% equity, 25% listed property and 45% offshore assets as prescribed.

What investment philosophy does Mi-Plan follow?

The fund follows a philosophy that alpha is generated from being able to assess the degree to which the rate of change in earnings growth differs from current consensus earnings estimates and is progressively discounted into each company’s share price. To assess this, the manager uses seven key inputs, namely: industry, X Factor, Brand, 4P’s (product, position, price, people), distribution, economic leverage and free cash flow impact on RoIC (return on invested capital). In reviewing each of these factors for each company, an understanding is arrived at that provides both a qualitative and quantitative assessment of how earnings growth rates may evolve. This approach, combined with some inference as to the market’s assessment of earnings growth prospects, completes the picture. Portfolio construction and drawdown risk management play a key role in the ultimate portfolio composition. Asset allocation and stock selection vary according to the manager’s macroeconomic view and the attractiveness of each asset class.

Who is the fund manager?

Tony Bell – Having started out as an accountant, Tony moved to Southern Life Asset Management and soon became assistant General Manager of Investments. His move to Syfrets Managed Assets created the opportunity for Tony to become Chief Investment Officer at Nedcor Investment Bank. As the former CIO of PeregrineQuant and Vunani Fund Managers (VFM), and more recently, the CIO of Thinkcell, Tony brings a wealth of experience especially in running the overall asset allocation of the fund. His MBA thesis “Portfolio Management an Alternative Approach” which was awarded with distinction reflects Tony’s interest in understanding how the macro environment affects markets and asset class returns.

Who is Mi-Plan?

Mi-Plan exists to create and preserve wealth through the application of critical thinking. Established in 2006, we assist our clients to manage their money to achieve their desired outcomes through understanding their future income objectives and then creating and managing the wealth required to meet those plans.

For more information about Mi-Plan visit: www.mi-plan.co.za

What are the fees?

The annual management fee for the fund is 0.75% (excl. VAT).

For more details regarding the fees of this fund, please view the factsheet.

How can I access the fund?

The Mi-Plan IP Balanced Defensive fund is available on the ABSA Investment Management Services, Allan Gray, Glacier, Ninety One (formerly Investec), Momentum, Old Mutual, PPS, PSG and Stanlib platforms.

Furthermore, to invest directly, click here.

For discretionary investments, the fund has a minimum investment requirement of R10 000 lump sum or a minimum monthly payment of R1000.

For Tax Free Savings Accounts (TFSA), the fund has a minimum lump sum investment requirement of R10 000; maximum lump sum investment of R36 000 lump sum, or a minimum monthly payment of R1000; maximum monthly payment of R3000.

Where can I get a factsheet or a minimum disclosure document?

The factsheet can be obtained from the Mi-Plan website.

Fund performance

|

|

1 Year Return |

3 Year Return* |

5 Year Return* |

10 Year Return* |

|

MI-PLAN IP Balanced Defensive fund B5 |

8.79% |

6.78% |

7.29% |

6.92% |

|

Fund Quartile Rank |

1 |

4 |

3 |

3 |

|

ASISA – South African Multi Asset Low Equity Sector Average |

7.24% |

8.05% |

7.66% |

6.90% |

|

Return |

|

|

Highest Annual Return (Rolling Maximum)** |

18.7% |

|

Lowest Annual Return (Rolling Lowest)** |

-5.8% |

Source: Morningstar; Performance as at 31 January 2024

* Returns are annualised if period is longer than 12 months. Based on B5 class.

Actual annual figures are available to the investor on request.

Annualised returns is the weighted average compound growth rate over the performance period measured. Fund returns shown are based on NAV-NAV unit pricings calculated from Morningstar for a lumpsum investment with income distribution reinvested (after fees and cost).

**The highest and lowest annual returns are based on rolling 1 year returns with 1 month steps.

For updated figures, please review the fund factsheet.

How do I contact Mi-Plan about the fund?

You can call us on 021 657 5960 or email info@miplan.co.za

Collective Investment Schemes are generally medium to long term investments. The value of participatory interests or the investment may go down as well as up. Past performance is not necessarily a guide to future performance. Collective investment schemes are traded at ruling prices and can engage in borrowing and scrip lending. A schedule of fees and charges and maximum commissions is available on request from the manager. Fund invest in portfolios of other Collective Investment Schemes that levy their own charges, which could result in a higher fee structure for the fund. The Manager does not provide any guarantee either with respect to the capital or the return of a portfolio. The Manager retains full legal responsibility for the Fund, regardless of Co-Naming arrangements. Transaction cut-off time is 14:30 daily. Each portfolio may be closed for new investments. Valuation time is 15:00 (17h00 at quarter end). Prices are published daily and available newspapers countrywide, as well as on request from the Manager. IP Management Company (RF) Pty Ltd is the authorised Manager of the Scheme – contact 021 673 1340 or clientservices@ipmc.co.za. Standard Bank is the trustee / custodian – contact compliance-IP@standardbank.co.za. Additional information including application forms, the annual report of the Manager and detailed holdings of the portfolio as at the last quarter end are available, free of charge, from clientservices@ipmc.co.za. IP Management Company is a member of ASISA. A statement of changes in the composition of the portfolio during the reporting period is available on request. The portfolio may include foreign investments and the following additional risks may apply: liquidity constraints when selling foreign investments and risk of non-settlement of trades; macroeconomic and political risks associated with the country in which the investment is made; risk of loss on foreign exchange transactions and investment valuation due to fluctuating exchange rates; risk of foreign tax being applicable; potential limitations on availability of market information which could affect the valuation and liquidity of an investment. All of these risks could affect the valuation of an investment in the fund.

For all disclosures please go to www.mi-plan.co.za/disclosure/

If you would like to print this advert, click here

MI-PLAN IP BALANCED FUND

A medium-equity fund ideal for moderate-risk investors requiring a growing regular income

Who is the fund aimed at?

The Mi-Plan IP Balanced fund is regulation 28 compliant fund and is aimed at retirees/discretionary investors who are ideally looking for a multi-asset strategy with diversified exposure to both, local and foreign asset classes with the following risk profiles and time horizons in mind:

| FUND | RISK PROFILE | MINIMUM TIME HORIZON |

| Mi-Plan IP Balanced fund | Moderate | 3-5 years |

Effective 24 January 2024, the following changes were made to the fund:

- Name change from Mi-Plan IP Inflation Plus 5 fund to Mi-Plan IP Balanced fund.

- Benchmark change from CPI +5% to the ASISA – South African Multi Asset Medium Equity sector average.

What are the investment objectives of the fund?

The fund aims to achieve moderate capital appreciation with reasonable volatility.

What does the fund invest in?

The fund invests in a mix of domestic and foreign asset classes, namely equities, fixed interest and cash. The fund complies with Regulation 28 limits and ASISA limits and are subject to a maximum of 60% equity, 25% listed property and 45% offshore assets as prescribed.

What investment philosophy does Mi-Plan follow?

The fund follows a philosophy that alpha is generated from being able to assess the degree to which the rate of change in earnings growth differs from current consensus earnings estimates and is progressively discounted into each company’s share price. To assess this, the manager uses seven key inputs, namely: industry, X Factor, Brand, 4P’s (product, position, price, people), distribution, economic leverage and free cash flow impact on RoIC (return on invested capital). In reviewing each of these factors for each company, an understanding is arrived at that provides both a qualitative and quantitative assessment of how earnings growth rates may evolve. This approach, combined with some inference as to the market’s assessment of earnings growth prospects, completes the picture. Portfolio construction and drawdown risk management play a key role in the ultimate portfolio composition. Asset allocation and stock selection vary according to the manager’s macroeconomic view and the attractiveness of each asset class.

Who is the fund manager?

Tony Bell – Having started out as an accountant, Tony moved to Southern Life Asset Management and soon became assistant General Manager of Investments. His move to Syfrets Managed Assets created the opportunity for Tony to become Chief Investment Officer at Nedcor Investment Bank. As the former CIO of PeregrineQuant and Vunani Fund Managers (VFM), and more recently, the CIO of Thinkcell, Tony brings a wealth of experience especially in running the overall asset allocation of the fund. His MBA thesis “Portfolio Management an Alternative Approach” which was awarded with distinction reflects Tony’s interest in understanding how the macro environment affects markets and asset class returns.

Who is Mi-Plan?

Mi-Plan exists to create and preserve wealth through the application of critical thinking. Established in 2006, we assist our clients to manage their money to achieve their desired outcomes through understanding their future income objectives and then creating and managing the wealth required to meet those plans.

For more information about Mi-Plan visit: www.mi-plan.co.za

How can I access the fund?

The Mi-Plan IP Balanced fund is available on the ABSA Investment Management Services, Allan Gray, Glacier, Ninety One (formerly Investec), Momentum, Old Mutual, PPS, PSG and Stanlib platforms.

Furthermore, to invest directly, click here.

For discretionary investments, the fund has a minimum investment requirement of R10 000 lump sum or a minimum monthly payment of R1000.

For Tax Free Savings Accounts (TFSA), the fund has a minimum lump sum investment requirement of R10 000; maximum lump sum investment of R36 000 lump sum, or a minimum monthly payment of R1000; maximum monthly payment of R3000.

What are the fees?

The annual management fee for the fund is 0.75% (excl. VAT).

For more details regarding the fees of this fund, please view the factsheet.

Where can I get a factsheet or a minimum disclosure document?

The factsheet can be obtained from the Mi-Plan website.

Fund performance

|

|

1 Year Return |

3 Year Return* |

5 Year Return* |

10 Year Return* |

|

MI-PLAN IP Balanced fund B5 |

7.12% |

6.83% |

7.09% |

6.5% |

|

Fund Quartile Rank |

2 |

4 |

3 |

3 |

|

ASISA – South African Multi Asset Medium Equity Sector Average |

5.98% |

8.64% |

8.31% |

6.89% |

|

Return |

|

|

Highest Annual Return (Rolling Maximum)** |

24.5% |

|

Lowest Annual Return (Rolling Lowest)** |

-10.9% |

Source: Morningstar; Performance as at 31 January 2024

* Returns are annualised if period is longer than 12 months. Based on B5 class.

Actual annual figures are available to the investor on request.

Annualised returns is the weighted average compound growth rate over the performance period measured. Fund returns shown are based on NAV-NAV unit pricings calculated from Morningstar for a lumpsum investment with income distribution reinvested (after fees and costs).

**The highest and lowest annual returns are based on rolling 1 year returns with 1 month steps.

For updated figures, please review the fund factsheet.

How do I contact Mi-Plan about the fund?

You can call us on 021 657 5960 or email info@miplan.co.za

Collective Investment Schemes are generally medium to long term investments. The value of participatory interests or the investment may go down as well as up. Past performance is not necessarily a guide to future performance. Collective investment schemes are traded at ruling prices and can engage in borrowing and scrip lending. A schedule of fees and charges and maximum commissions is available on request from the manager. Fund invest in portfolios of other Collective Investment Schemes that levy their own charges, which could result in a higher fee structure for the fund. The Manager does not provide any guarantee either with respect to the capital or the return of a portfolio. The Manager retains full legal responsibility for the Fund, regardless of Co-Naming arrangements. Transaction cut-off time is 14:30 daily. Each portfolio may be closed for new investments. Valuation time is 15:00 (17h00 at quarter end). Prices are published daily and available newspapers countrywide, as well as on request from the Manager. IP Management Company (RF) Pty Ltd is the authorised Manager of the Scheme – contact 021 673 1340 or clientservices@ipmc.co.za. Standard Bank is the trustee / custodian – contact compliance-IP@standardbank.co.za. Additional information including application forms, the annual report of the Manager and detailed holdings of the portfolio as at the last quarter end are available, free of charge, from clientservices@ipmc.co.za. IP Management Company is a member of ASISA. A statement of changes in the composition of the portfolio during the reporting period is available on request. The portfolio may include foreign investments and the following additional risks may apply: liquidity constraints when selling foreign investments and risk of non-settlement of trades; macroeconomic and political risks associated with the country in which the investment is made; risk of loss on foreign exchange transactions and investment valuation due to fluctuating exchange rates; risk of foreign tax being applicable; potential limitations on availability of market information which could affect the valuation and liquidity of an investment. All of these risks could affect the valuation of an investment in the fund.

For all disclosures please go to www.mi-plan.co.za/disclosure/

If you would like to print this advert, please click here.

MI-PLAN IP BALANCED PLUS

A high-equity fund ideal for high-risk retired/discretionary investors requiring a growing capital growth on their investment

Who is the fund aimed at?

The Mi-Plan IP Balanced Plus fund is regulation 28 compliant fund and is aimed at retirees/discretionary investors who are ideally looking for a multi-asset strategy with diversified exposure to both, local and foreign asset classes with the following risk profiles and time horizons in mind:

| FUND | RISK PROFILE | MINIMUM TIME HORIZON |

| Mi-Plan IP Balanced Plus fund | Aggressive | >5 years |

Effective 24 January 2024, the following changes were made to the fund:

- Name change from Mi-Plan IP Inflation Plus 7 fund to Mi-Plan IP Balanced Plus fund.

- Benchmark change from CPI +7% to the ASISA – South African Multi Asset High Equity sector average.

What are the investment objectives of the fund?

The fund aims to achieve aggressive capital appreciation with reasonable volatility.

What does the fund invest in?

The fund invests in a mix of domestic and foreign asset classes, namely equities, fixed interest and cash. The fund complies with Regulation 28 limits and ASISA limits and are subject to a maximum of 60% equity, 25% listed property, and 45% offshore assets as prescribed.

What investment philosophy does Mi-Plan follow?

The fund follows a philosophy that alpha is generated from being able to assess the degree to which the rate of change in earnings growth differs from current consensus earnings estimates and is progressively discounted into each company’s share price. To assess this, the manager uses seven key inputs, namely: industry, X Factor, Brand, 4P’s (product, position, price, people), distribution, economic leverage and free cash flow impact on RoIC (return on invested capital). In reviewing each of these factors for each company, an understanding is arrived at that provides both a qualitative and quantitative assessment of how earnings growth rates may evolve. This approach, combined with some inference as to the market’s assessment of earnings growth prospects, completes the picture. Portfolio construction and drawdown risk management play a key role in the ultimate portfolio composition. Asset allocation and stock selection vary according to the manager’s macroeconomic view and the attractiveness of each asset class.

Who is the fund manager?

Tony Bell – Having started out as an accountant, Tony moved to Southern Life Asset Management and soon became assistant General Manager of Investments. His move to Syfrets Managed Assets created the opportunity for Tony to become Chief Investment Officer at Nedcor Investment Bank. As the former CIO of PeregrineQuant and Vunani Fund Managers (VFM), and more recently, the CIO of Thinkcell, Tony brings a wealth of experience especially in running the overall asset allocation of the fund. His MBA thesis “Portfolio Management an Alternative Approach” which was awarded with distinction reflects Tony’s interest in understanding how the macro environment affects markets and asset class returns.

Who is Mi-Plan?

Mi-Plan exists to create and preserve wealth through the application of critical thinking. Established in 2006, we assist our clients to manage their money to achieve their desired outcomes through understanding their future income objectives and then creating and managing the wealth required to meet those plans.

For more information about Mi-Plan visit: www.mi-plan.co.za

What are the fees?

The annual management fee for the fund is 0.75% (excl. VAT).

For more details regarding the fees of this fund, please view the factsheet.

How can I access the fund?

The Mi-Plan IP Balanced Plus fund is available on the ABSA Investment Management Services, Allan Gray, Glacier, Ninety One (formerly Investec), Momentum, Old Mutual, PPS, PSG and Stanlib platforms.

Furthermore, to invest directly, click here.

For discretionary investments, the fund has a minimum investment requirement of R10 000 lump sum or a minimum monthly payment of R1000.

For Tax Free Savings Accounts (TFSA), the fund has a minimum lump sum investment requirement of R10 000; maximum lump sum investment of R36 000 lump sum, or a minimum monthly payment of R1000; maximum monthly payment of R3000.

Where can I get a factsheet or a minimum disclosure document?

The factsheet can be obtained from the Mi-Plan website.

How good is the performance?

|

|

1 Year Return |

3 Year Return* |

5 Year Return* |

10 Year Return* |

|

MI-PLAN IP Balanced Plus fund B5 |

7.16% |

7.34% |

7.3% |

6.92% |

|

Quartile Rank |

2 |

4 |

4 |

3 |

|

South African Multi Asset High Equity Sector Average |

5.83% |

9.46% |

8.83% |

7.08% |

|

Return |

|

|

Highest Annual Return (Rolling Maximum)** |

27.3% |

|

Lowest Annual Return (Rolling Lowest)** |

-18.1% |

Source: Morningstar; Performance as at 31 January 2024

* Returns are annualised if period is longer than 12 months. Based on B5 class.

Actual annual figures are available to the investor on request.

Annualised returns is the weighted average compound growth rate over the performance period measured. Fund returns shown are based on NAV-NAV unit pricings calculated from Morningstar for a lumpsum investment with distribution reinvested (after fees and costs).

**The highest and lowest annual returns are based on rolling 1 year returns with 1 month steps

For updated figures, please review the fund factsheet.

How do I contact Mi-Plan about the fund?

You can call us on 021 657 5960 or email info@miplan.co.za

Collective Investment Schemes are generally medium to long term investments. The value of participatory interests or the investment may go down as well as up. Past performance is not necessarily a guide to future performance. Collective investment schemes are traded at ruling prices and can engage in borrowing and scrip lending. A schedule of fees and charges and maximum commissions is available on request from the manager. Fund invest in portfolios of other Collective Investment Schemes that levy their own charges, which could result in a higher fee structure for the fund. The Manager does not provide any guarantee either with respect to the capital or the return of a portfolio. The Manager retains full legal responsibility for the Fund, regardless of Co-Naming arrangements. Transaction cut-off time is 14:30 daily. Each portfolio may be closed for new investments. Valuation time is 15:00 (17h00 at quarter end). Prices are published daily and available newspapers countrywide, as well as on request from the Manager. IP Management Company (RF) Pty Ltd is the authorised Manager of the Scheme – contact 021 673 1340 or clientservices@ipmc.co.za. Standard Bank is the trustee / custodian – contact compliance-IP@standardbank.co.za. Additional information including application forms, the annual report of the Manager and detailed holdings of the portfolio as at the last quarter end are available, free of charge, from clientservices@ipmc.co.za. IP Management Company is a member of ASISA. A statement of changes in the composition of the portfolio during the reporting period is available on request. The portfolio may include foreign investments and the following additional risks may apply: liquidity constraints when selling foreign investments and risk of non-settlement of trades; macroeconomic and political risks associated with the country in which the investment is made; risk of loss on foreign exchange transactions and investment valuation due to fluctuating exchange rates; risk of foreign tax being applicable; potential limitations on availability of market information which could affect the valuation and liquidity of an investment. All of these risks could affect the valuation of an investment in the fund.

For all disclosures please go to www.mi-plan.co.za/disclosure/.

If you would like to print this advert, please click here.