If you are a financial adviser and are interested in using our model portfolio solutions please email analytics@miplan.co.za to arrange a meeting. Existing investors can find fact sheets, process documentation and quarterly updates by registering and logging into the Mi-Gateway portal.

The challenge for a financial adviser is that, with hundreds of unit trusts in existence, how does one choose among them? How are they synergistically combined to ensure that they meet client’s investment objectives? For an individual adviser, this can be a major challenge. Coupled with the size of investment universes, the information and skills available to advisers is often limited, making it difficult to construct an effective solution.

Benefits for advisers

A model portfolio addresses the adviser’s challenges by providing a complete solution through a single investment product. MiPlan’s model portfolios are designed to simplify an adviser’s work as they are scalable and cost-effective investment strategies which individually, or in combination, can be used for any type of client. This simplification is particularly necessary for advisers who have a big client base which makes managing their clients’ investments on an individual basis almost impossible. Model portfolios are also key if an adviser is wanting to scale their business and client base. On a day-to-day basis, an adviser will no longer have to worry about the following:

- Portfolio creation

- Administration and compliance

- Risk management

- Investment process

- Due diligence

- Portfolio monitoring

The basic principle of a model portfolio is the grouping of more than one unit trust to form a portfolio, the premise being that a single unit trust fund seldom ranks consistently as the top performing fund. Different managers have different areas of expertise, be it asset allocation, stock selection, investment style, etc. A well-structured model portfolio solution will focus not only on the identification of superior funds but also on blending them together in a way that takes advantage of complementary manager skills. With the right mix of funds, synergy can be achieved.

Additionally, all advisers who use the MiPlan model portfolios are granted complimentary access to MI-PLAN – advanced time-based, liability matching financial planning software. This allows the advisor to integrate the model portfolios into their client’s overall financial plan.

Benefits for clients

A model portfolio provides access to the skills of some of the best investment managers, blends funds synergistically, and improves the client’s chance of achieving their investment goals. By opting for a model portfolio solution, the client may be afforded the following benefits:

- Diversification of manager risk

- Cost effective

- Comprehensive due diligence of all managers

- Ongoing portfolio monitoring

- Focus on investment objectives

MiPlan’s investment philosophy is based on selecting the right asset managers, understanding their ‘DNA’, and blending them together to achieve synergy. Important aspects of manager DNA are:

- How have the managers performed in comparison to peers?

- How volatile have they been in comparison to peers?

- How consistently has the manager “got it right”?

- Have the managers successfully protected the downside?

MiPlan offers both generic and bespoke (personalised) model portfolio solutions. Typically, an adviser will be given access to a range of target return portfolios which aim to achieve returns in-excess-of benchmark returns of CPI +2%; CPI +4%; and CPI +6%; and a flexible type portfolio with a composite index benchmark. These portfolios individually or in combination, allow the investor the greatest likelihood of attaining their financial goals. The product design and investment philosophy are key to the achievement of these goals.

Portfolio creation

Funds are first analysed within their full universe alongside all peers. Various risk measures are compared to returns over time. Selecting candidates differs depending on the portfolio. High returns with minimum exposure to risk are ideal but, by design, earning higher returns generally involves taking on more risk. For the more conservative portfolios we are more conscious of protecting the downside and so we are willing to sacrifice some returns to improve the risk characteristics of the portfolio. For the more aggressive portfolios, on-the-other-hand, the focus shifts to higher returns with a greater risk tolerance.

We aim to combine managers with different DNA to create synergy – the 1+1=3 philosophy. The process involves combining some higher risk, higher return managers with some lower-risk, lower-return managers which serve as the stable core for the portfolio.

Additional factors which form part of our process are the likelihood of the fund outperforming its peer average, fees, risk management from a bottom-up holdings perspective, and qualitative factors (reputation, confidence in brand, quality and stability of management team, size constraints of the fund, understanding of manager’s position, remaining true to DNA).

Monitoring

Funds are monitored and reviewed monthly to ensure that they do not deviate from their ‘DNA’ which led to their inclusion in the portfolio. Any drift in the manager’s position within the quantitative framework serves as a trigger for further investigation and qualitative analysis (see points listed above) which may involve onsite visits to the manager to discuss current positions and any changes in philosophy or process.

If ‘DNA drift’ is detected and deemed significant we will drill deeper to establish the cause of the drift – have there been material changes in DNA or is it simply a temporary market related drift? If the fund’s DNA has changed materially then this may warrant removal or substitution of the fund for another.

MiPlan provides advisers with the following documentation:

- Process documentation

- Monthly newsletters

- Monthly reports

- Quarterly reports

All documents are made available online via our portal Mi-Gateway.

Investment Committee Meetings

Investment committee meetings are held at least semi-annually during which the adviser will meet with the MiPlan team who will report back on any changes that have been made to the portfolios, discuss market movements and the MiPlan multi-manager research process, as discussed above.

MiPlan’s model portfolios are available on the following Linked Investment Service Providers (LISPs):

- Allan Gray

- ABSA

- Glacier

- Ninety One (formerly Investec)

- Momentum

- Old Mutual

- PPS

- Stanlib

However, efforts will be made to make the portfolios available on other platforms if it is critical for an adviser to have access to the portfolios on another platform.

Flexible Income

Key Facts

| Inception date | 14 August 2017 |

| Objective | Cash Plus (after annual Unit Trust fees) |

| Reg. 28 Compliant | Yes |

| Asset Composition | Equity, Fixed Interest, Property, and Cash |

| Benchmark | STeFI |

| Income Declaration | Reinvested |

| Fees | 0.1% per annum (excl. VAT) |

Suitability

This strategy is suitable for conservative investors with a minimum investment time horizon of two years. The Flexible Income portfolio also forms part of MiPlan’s range of risk-controlled portfolios in a time-based process designed to integrate the portfolio construction framework with our proprietary financial planning software called MI-PLAN.

Objectives

The strategy aims to achieve returns in excess of money market assets (SteFI) over a rolling 2-year period after annual Unit Trust costs, while maintaining low risk of capital loss. The recommended minimum investment time horizon is at least two years.

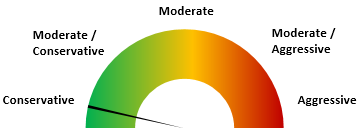

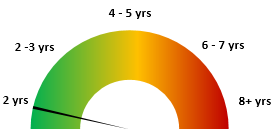

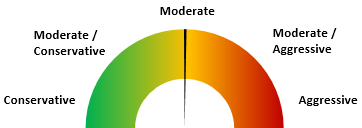

Risk Profile

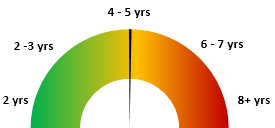

Time Horizon

Inflation Plus 2-3

Key Facts

| Inception date | 30 September 2015 |

| Objective | CPI + 2-3% (after fees) |

| Reg. 28 Compliant | Yes |

| Asset Composition | Equity, Fixed Interest, Property, and Cash |

| Benchmark | CPI +2% |

| Income Declaration | Reinvested |

| Fees | 0.2% per annum (excl. VAT) |

Suitability

This portfolio is suitable for moderate-conservative investors with an investment time horizon of two to three years. The Inflation Plus 2-3 Portfolio forms part of MiPlan’s range of risk-controlled portfolios in a time-based process designed to integrate the portfolio construction framework with our proprietary financial planning software called MI-PLAN.

Objectives

The strategy aims to achieve returns per annum of 2-3% in excess of inflation over a rolling 3 year period after annual Unit Trust costs, while maintaining acceptable levels of risk exposure. The recommended time horizon is at least two years.

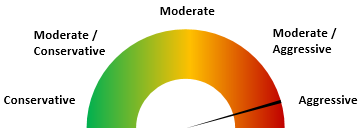

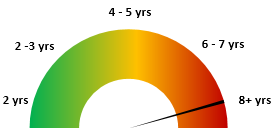

Risk Profile

Time Horizon

Inflation Plus 4-5

Key Facts

| Inception date | 30 September 2015 |

| Objective | CPI + 4-5% (after fees) |

| Reg. 28 Compliant | Yes |

| Asset Composition | Equity, Fixed Interest, Property, and Cash |

| Benchmark | CPI +4% |

| Income Declaration | Reinvested |

| Fees | 0.2% per annum (excl. VAT) |

Suitability

This strategy is suitable for moderate investors with an investment time horizon of four to five years. The Inflation Plus 4-5 Portfolio forms part of MiPlan’s range of risk-controlled portfolios in a time-based process designed to integrate the portfolio construction framework with our proprietary financial planning software called MI-PLAN.

Objectives

The strategy aims to achieve returns per annum of 4-5% in excess of inflation over a rolling 5 year period after annual Unit Trust costs, while maintaining acceptable levels of risk exposure. The recommended time horizon is at least 4 years.

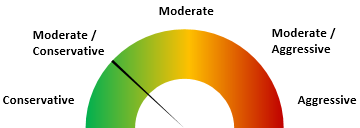

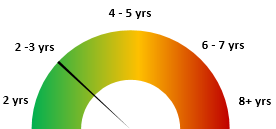

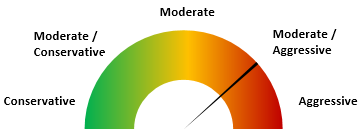

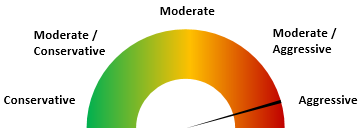

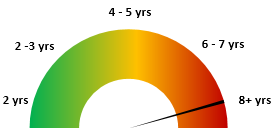

Risk Profile

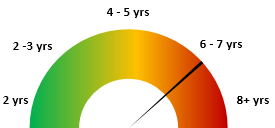

Time Horizon

Inflation Plus 6-7

Key Facts

| Inception date | 30 September 2015 |

| Objective | CPI + 6-7% (after fees) |

| Reg. 28 Compliant | Yes |

| Asset Composition | Equity, Fixed Interest, Property, and Cash |

| Benchmark | CPI +6% |

| Income Declaration | Reinvested |

| Fees | 0.2% per annum (excl. VAT) |

Suitability

This strategy is suitable for moderate-aggressive investors with an investment time horizon of six to seven years. The Inflation Plus 6-7 Portfolio forms part of MiPlan’s range of risk-controlled portfolios in a time-based process designed to integrate the portfolio construction framework with our proprietary financial planning software called MI-PLAN.

Objectives

The strategy aims to achieve returns per annum of 6-7% in excess of inflation over a rolling 7-year period after annual Unit Trust costs, while maintaining acceptable levels of risk exposure. The recommended time horizon is at least 6 years.

Risk Profile

Time Horizon

Flexible Growth

Key Facts

| Inception date | 2 November 2015 |

| Objective | Long-term Capital Growth |

| Reg. 28 Compliant | No |

| Asset Composition | Equity, Fixed Interest, Property, and Cash |

| Benchmark | 40% Foreign Equity (40% MSCI) 25% Local Equity (25% JSE ALSI) 30% Local F.I. (30% STeFI) 5% Local Property (5% J253) |

| Income Declaration | Reinvested |

| Fees | 0.2% per annum (excl. VAT) |

Suitability

This strategy is suitable for aggressive investors with an investment time horizon of more than eight years. The Flexible Growth Portfolio forms part of MiPlan’s range of risk-controlled portfolios in a time-based process designed to integrate the portfolio construction framework with our proprietary financial planning software called MI-PLAN.

Objectives

The strategy aims to achieve long-term capital growth, while maintaining acceptable levels of risk exposure. The recommended time horizon is at least eight years.

Risk Profile

Time Horizon

Global Flexible Growth

Key Facts

| Inception date | 12 January 2018 |

| Objective | Long-term Capital Growth |

| Reg. 28 Compliant | No |

| Asset Composition | Equity, Fixed Interest, Property, and Cash |

| Benchmark | 50% Global Equity General Sector, 50% Global MultiAsset Flexible Sector |

| Income Declaration | Reinvested |

| Fees | 0.2% per annum (excl. VAT) |

Suitability

This strategy is suitable for aggressive investors with an investment time horizon of more than eight years. The Global Flexible Growth Portfolio forms part of MiPlan’s range of risk-controlled portfolios in a time-based process designed to integrate the portfolio construction framework with our proprietary financial planning software called MI-PLAN.

Objectives

The strategy aims to achieve long-term capital growth, while maintaining acceptable levels of risk exposure. The recommended time horizon is at least eight years.

Risk Profile

Time Horizon

If you are a financial adviser and are interested in using our model portfolio solutions please email analytics@miplan.co.za to arrange a meeting.