MiPlan offers a unique range of funds spanning the risk spectrum which have been set up to target certain outcomes or objectives, based on various investment time horizons:

What assets to invest in?

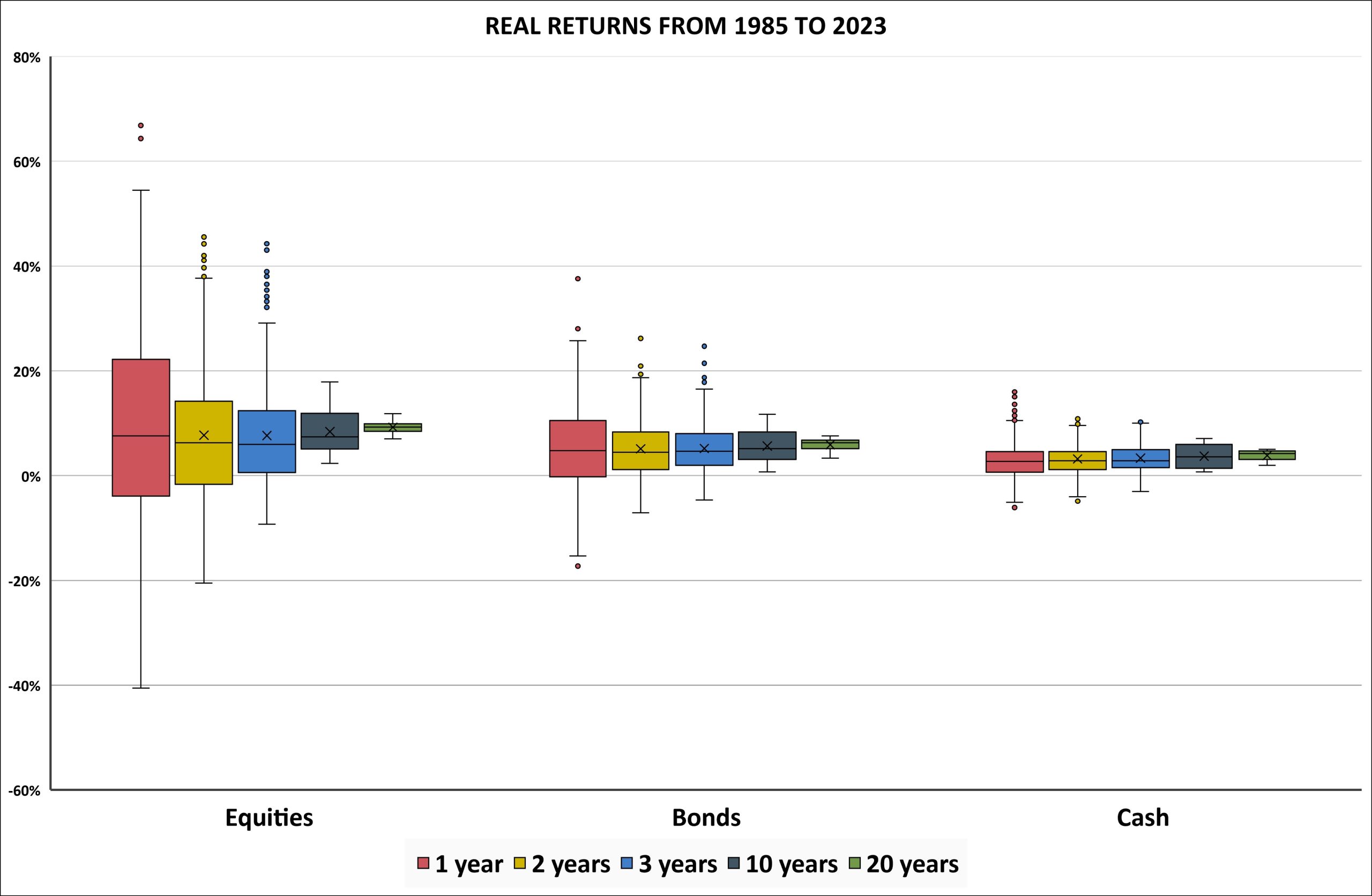

In deciding how to invest, you need to know how the asset classes you invest in behave over time. The graph below depicts real returns (i.e. after inflation) from cash, bonds and equities over discrete periods ranging from one to twenty years.

Note: Annualised, real returns from 31st December 1985 to 31st January 2023, indicating the maximum, minimum, upper quartile, lower quartile and median returns. Past performance is not a guarantee of future results.

Source: Rowan Williams-Short, Portfolio Manager; Iress.

The graph reveals that for any given holding period, the median real return on equities is higher than on bonds, which is in turn higher than on cash. However as shown by the ranges, the risk of holding equities is higher than bonds, which is higher than cash. Critically as the holding period increases (for any of the asset classes), the real return becomes more dependable, i.e. the ranges shrink. For example, one-year returns on equities have ranged from -41% to +54%. However, over 20-year holding periods, these have ranged from 7% to 12%. In other words, the longer you are invested in equities, the lower the volatility (risk) and the more likely the asset class will outperform other asset classes. This is important as it defines how to best use a “risk budget” within your financial plan.

What is risk?

Typically, your risk appetite is determined by a questionnaire or test which attempts to evaluate your tolerance of risk. Some of these approaches, whilst well meaning, are fundamentally flawed in that they fail to inform you of the key benefit associated with risk diversification over time. We advocate time-based risk management which focuses on your time horizon and as opposed to your emotions to risk – being too conservative can be far more damaging to your financial plan and needs than you may imagine.

This link between risk and time is a fundamental concept to understand when investing. The cash flows you have to invest (wealth creation) as well as the cash flows you will require during retirement (retirement income), and any other income requirements.

How to invest

Ideally, your cash flow requirements and contributions should be matched to a range of funds which correspond to various return objectives, risk profiles, time horizons, and asset allocation flexibility. This is the underlying philosophy behind the process of MiPlan’s financial planning software – the allocation of annual investments between funds with various investment time horizons and risk profiles whilst accounting for withdrawals. This process allows for more efficient use of risk with greater certainty of outcome.