By Personal Finance, 2nd Quarter 2020*

The Mi-Plan IP Global Macro Fund is a global multi-asset flexible fund that has performed remarkably well for its investors. It was recognised for its performance to the end of 2019 at January’s Raging Bull Awards, winning certificates for the best global multi-asset flexible fund for straight performance over three years and for risk-adjusted performance over five years. To the end of the first quarter this year, the rand-denominated fund delivered 18.57% over one year (6th in its subcategory) and an annualised return of 14.49% over five years (1st in its subcategory), according to ProfileData. The fund, which has the flexibility to invest in any offshore asset classes in any proportions, is suitable for investors with a longer-term investment horizon seeking actively managed exposure to global equity opportunities, allowing for short-term volatility but seeking to minimise long-term downside risk. Personal Finance found out more about the company and the fund from the chief executive of Mi-Plan, Anton Turpin, and fund manager Tony Bell.

Mi-Plan recently won the Raging Bull Award for South African Manager of the Year. To what do you attribute your success?

Anton Turpin: Mi-Plan’s philosophy to critically evaluate, identify and appoint asset managers who are best in their class underpins our ability to achieve industry-beating risk-adjusted returns for our clients. Understanding which skills are key for each fund in its respective category and matching this need with that of a particular fund manager’s skills gives us our advantage. Unlike most asset management houses, Mi-Plan is not limited to one house. However, clients are not always made aware of the smaller companies. We trust that the acknowledgement of receiving the Raging Bull Award for South African Manager of the Year will make clients, and their planners, reassess how to choose funds to manage their hard earned capital in future.

Your fees are relatively low, with a management fee of just 1%. How are you able to keep costs low for investors while providing top-class active management?

AT: In a market dominated by brand, where investors and their advisers are often influenced by extensive advertising and marketing campaigns, it may come as surprise to some investors that they may actually be paying to create this presence. At Mi-Plan we do not spend large amounts on branding or marketing. You will not see us advertising on television or at the airport for example, as that is very costly. We choose to pass these savings on to the client. We would also rather rely on informed advisers or multi-managers to choose our funds on behalf of investors. Technology delivers this information at low cost to them, and the relative advantages of the Mi-Plan funds to advisers and multi-managers. Ultimately they too must bear responsibility and deliver stable, risk-adjusted returns to clients at low cost in order to meet clients’ financial objectives. As clients become more informed and engaged with their investments, they, in turn, will look beyond brand only.

Can you outline your investment philosophy for the fund?

Tony Bell: There are two points of focus. The first is to identify companies within the global universe who are or have the ability to increase the rate of change in earnings growth. The second is to aggressively manage drawdown risk. The philosophy behind the first point is that alpha is generated not by forecasting earnings one, two or three years ahead, but by correctly estimating the rate of change of a company’s earnings “a priori”. It is common cause that “the market” already knows about consensus estimates and any change to these, so using these estimates as a basis for generating alpha in the global universe is not productive.

To what do you attribute its excellent performance?

TB: The fund has delivered on its philosophy by successfully integrating alpha generation and risk management. Howard Marks, in his much publicised newsletters to clients, spoke of the difference between simple and complex analysis. Simple projections based on a variation of consensus earnings is unlikely to produce “alpha”. In most cases alpha is a product of portfolio weighting schemes rather than uncovering some hidden “value” in a stock. In the global macro world we seek out those companies that have a combination of seven distinct profit drivers: industry, X-factor, brand, product, position, price and margin. These combine with distribution and economic leverage to deliver free cash flow. The latter forms the basis of our analysis into improved return on equity. When one or more of these factors change, we review the investment case and often begin to proportionally reduce our position in a stock.

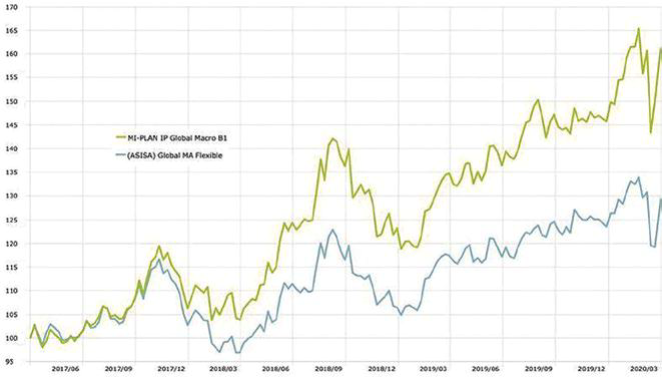

Three-year performance to 31 March, 2020

In February you had the fund relatively defensively positioned, with 30% in offshore cash. Was the virus a factor, or had you taken a defensive stance before the onset of Covid-19?

TB: The virus was a factor. But more importantly, we had identified the “freeze” in the interbank market in the US during the last quarter of 2019. Based on past experience, we closely monitor the transmission mechanisms in liquidity between the primary and secondary markets. Loosely defined, the primary market exists between a reserve bank and the commercial banks whereas the secondary market exists between the banks and companies/Individuals. The sub-prime crisis of 2018 occurred in the secondary market, where banks had become overzealous in granting credit to home buyers. In late 2019 the primary market started to freeze as banks had extended their leverage in certain transactions and were running their reserve ratios, so that any increase in interest rates would push them into a more delicate liquidity position. It should, therefore have come as no surprise, after the US Federal Reserve started to raise interest rates in 2017, that a point would be reached when US banks ran into trouble. We held the view in January this year that the primary risk to equity markets was a liquidity crunch. Covid-19 exacerbated the downturn by annihilating the earnings growth prospects of a number of sectors.

Are you now seeing buying opportunities?

TB: Buying opportunities should be seen against the background of a very rapidly changing macro-economic picture. Our primary concern at this point is the contagion risk sweeping across the US and the lockdowns in the UK and other parts of Europe. We may well be in the first phase of moving from a liquidity crisis to a solvency crisis. But it is simply too soon to tell. We increased equity exposure from 55% mid-March to 68%, as risks appear to have ameliorated somewhat with the Fed’s unprecedented stimulus package. But risks to this picture remain. The US is far from the levels of quarantine needed, with opinions varied as to whether this is even necessary. Vigilance remains the watchword.

Tony Bell