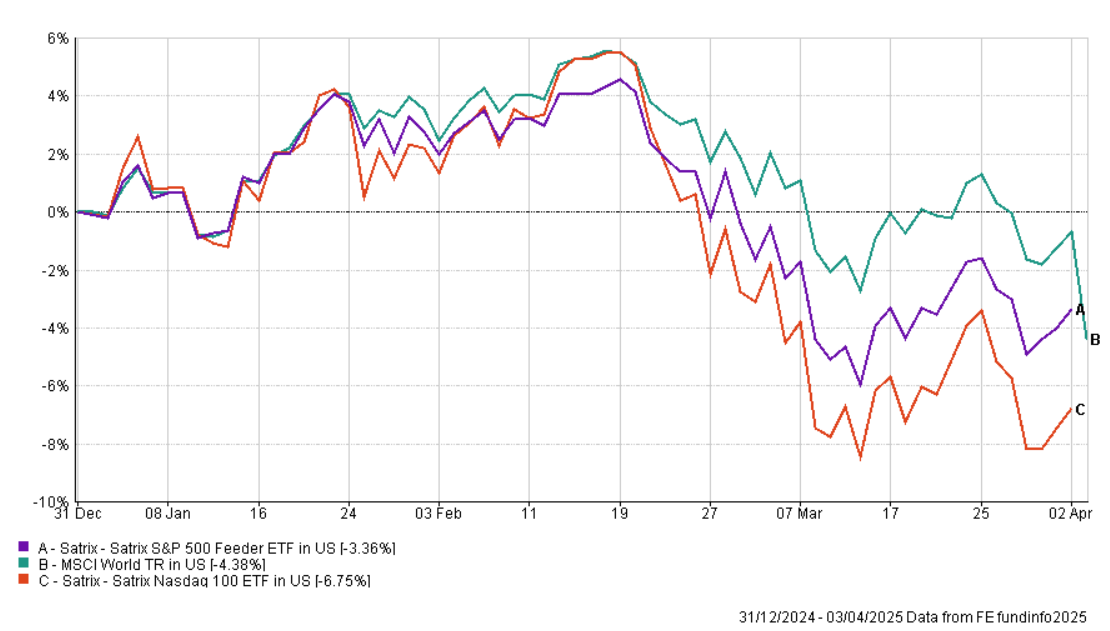

Earlier this week, President Trump announced a broad range of tariffs across nearly 184 countries. These exceeded market expectations by quite a margin, leading to a sharp sell-off in key equity market sectors around the world. Bond yields in the US fell sharply, indicating slower growth expectations, while the dollar weakened.

Chart 1: Global Equity Markets Year to Date

Understanding Tariffs in a Nutshell

It seems that there is a great deal of confusion around tariffs. Many Americans have been sold on the concept that the exporting country pays for tariffs and that the policy pursued by President Trump redresses past imbalances. While this is partly true, the simple position is that tariffs are taxes paid by the American importer. The tax, paid by the importer at the point of entry, goes to the US government. The exporting country pays no tax. The impact on US consumers is that they pay more for their imported goods. So, a car imported from China costs 30% more today than it did yesterday.

Why is the US implementing this framework?

In November last year, Trump’s key economic advisor, Stephen Miran, published a paper focusing on restructuring the global trading system. The basic thesis is that the US is burdened by having to fund the rest of the world’s growth as it needs to continue to create the dollars required. The framework recommends the need for tariffs to address trade deficits and recommends devaluation of the dollar, although it acknowledges that this (dollar devaluation) thesis has never been tested.

How we have addressed these risks in the MiPlan IP Global Macro Fund?

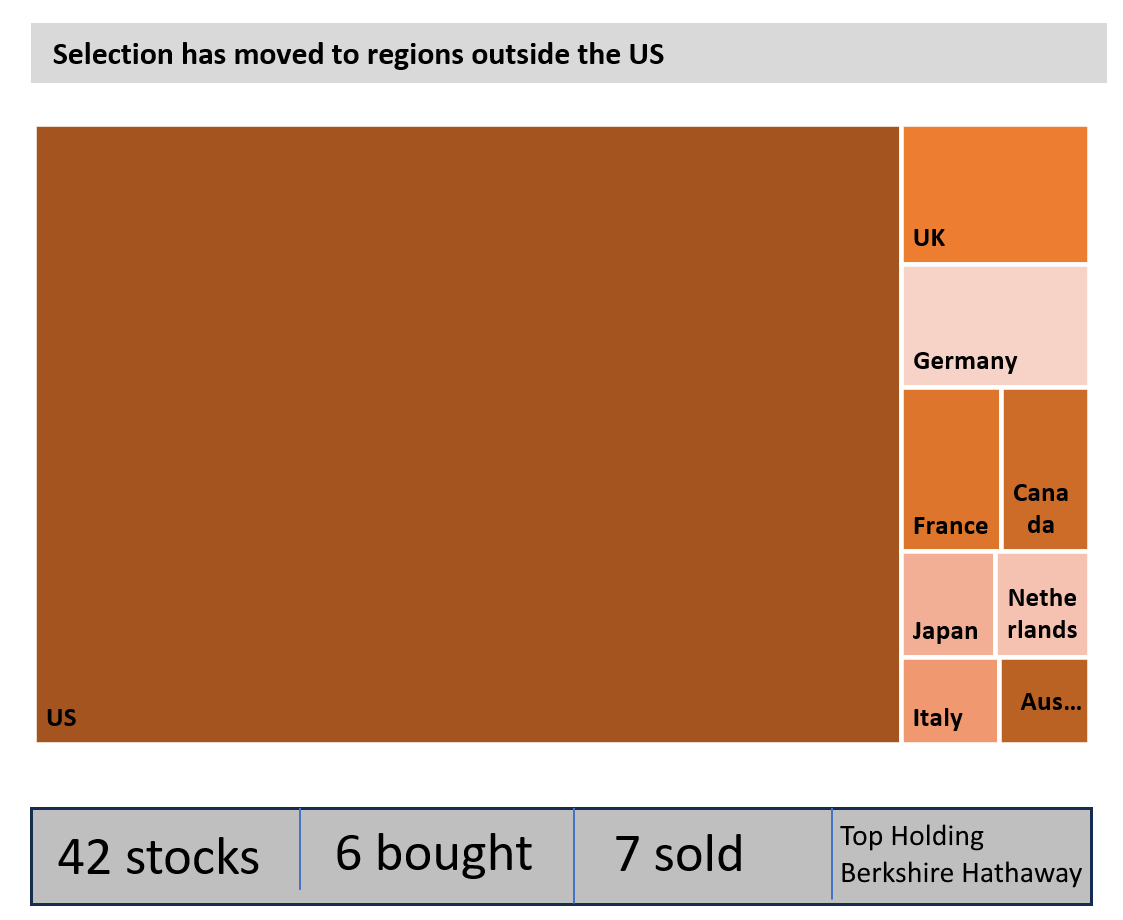

In late December 2024, we started derisking the portfolio by trimming exposure to several high-profile stocks that looked very full. In early February, we took this adjustment process to a new level by aggressively adjusting exposure to many of the high-beta stocks we assessed as vulnerable to Trump’s policy changes. We added Berkshire Hathaway, Gold, and defensive positions in Philip Morris and IBM, increased our exposure to Asia and Europe, added to our US bond position, and transferred USD to EURO. Cash invested in US government bonds (both short-dated and long-dated) now approximates 9% of fund value. We have positioned your portfolio extremely conservatively, with nearly 30% in cash, and the bulk of equity exposure is now focused on very defensive stocks such as Berkshire Hathaway at 5%.

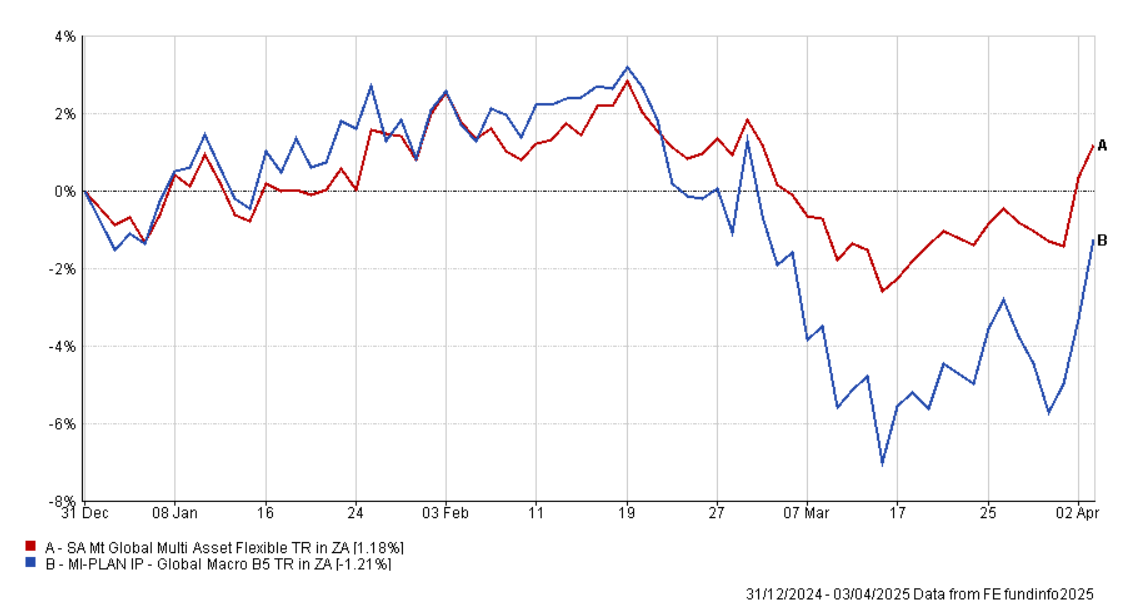

As the chart below shows, portfolio performance has weathered the storm well, given its historic positioning in high beta high growth stocks.

Signals we are monitoring:

- The direction of US long bond yields – current 10-year yields are at 4.1% and falling. This signals weaker economic growth ahead for the US – we have positioned accordingly.

- Trade-weighted dollar – the weakness we have seen since the start of the year is reflective of investors moving out of US equities

- Key currencies such as the Euro and Yen – strength in these currencies point to a clear shift away from the US dollar

- Volatility (VIX Index) is currently elevated due to policy uncertainty – any further escalation would add additional protection measures to the portfolio

- Gold – the ultimate hedge – we have added to our position.

Outside of these negatives, we see opportunities in several high-quality growth stocks. Time is on our side as we have a very high cash position linked to a very defensive equity position to manage current market risk and volatility.

Tony Bell (Fund Manager)