Notification Of Impairment Of Side-Pocketed Assets

Investors in the MiPlan IP Enhanced Income Retention Fund are notified that Vunani Fund Managers have decided to decrease the fair value of the side-pocketed Redink and Martius instruments in the Retention Fund.

The notification from Vunani Fund Managers is set out below, which includes the rationale for and extent of the impairments.

Following consultations with the Trustee and the Administrators, the impairments will be with effect from Friday, 1 March 2024.

Please note that these impairments do not affect the value of the assets in or the pricing of the MiPlan IP Enhanced Income Fund.

This notice is issued in terms of and in compliance with the conditions prescribed by the Financial Sector Conduct Authority in approving the side-pocketing on the above side-pocketed assets.

27 February 2024

Notification of Impairment of RedInc and Martius instruments

Vunani Fund Managers has had extensive engagements over the past few weeks with both the issuer (RedInc) and the management of the Service agent (Mokoro) regarding the two SPV structures in which the below notes reside. Despite the SPVs performing satisfactorily, financial distress at the service provider level has led to subpar collections. Unfortunately, legal restrictions prevent the issuer from providing us with the detailed data needed for a comprehensive valuation.

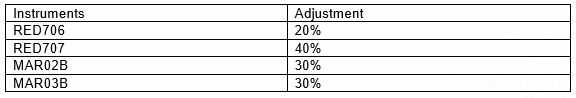

Based on the available information, including direct engagements and other correspondence, and our best efforts assessment, we have decided to decrease the fair value of the various instruments, as outlined below. These adjustments vary based on considerations of seniority and claims to underlying cashflows within the securitised structures.

Vunani Fund Managers is in the process of appointing an independent valuator. This step, coupled with any new information that emerges, may necessitate a review of the above adjustments.

Furthermore, VFM maintains regular meetings with the issuer, underlying service agent, and other debtholders. This approach ensures that we stay informed and can adapt strategies as the situation evolves.