Investors in the MiPlan range of Unit Trust funds will be relieved to hear that our funds held no exposure to Steinhoff debt and limited exposure to Steinhoff International (SNH).

The largest exposure on 5th December by any MiPlan fund in Steinhoff International (SNH) was a holding of 1.85% of assets in the MiPlan Beta Fund.

Importantly this fund is the only passively managed fund in the stable with the objective to replicate the average weighting of all managers in the General Equity Sector. It therefore has to hold Steinhoff International (SNH), and it serves as a useful proxy to view the holdings of Steinhoff International (SNH) relative to the other actively managed MiPlan funds.

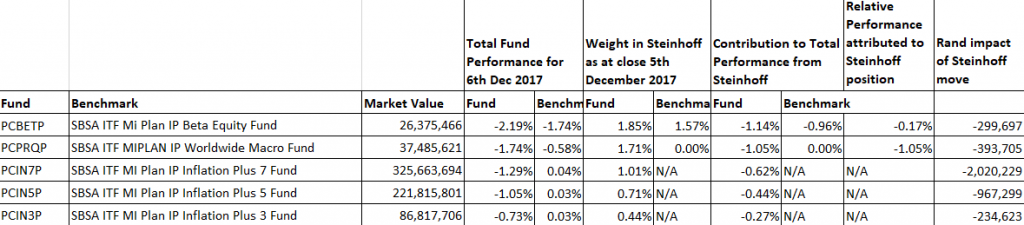

The actively managed funds held substantially less exposure as a percentage of their assets. The summary below illustrates these positions and, importantly, the impact on the performance of funds.

Only the MiPlan listed below had any exposure to Steinhoff:

Manager Tony Bell has set out a summary of the events that led to the fall in the share price of Steinhoff International (SNH) and a view on the valuation of the holding at the current price:

“Our investment process is based on fundamental company research that seeks to establish a fair value based on audited results and corroborating information. Recent events related to Steinhoff suggest that the auditors may have been remiss in expressing an opinion on the fairness of the historic financial position of the group. Similarly, the rating agencies appear to have been caught short, having rated the debt as investment grade. What is unclear at this point is the extent of any misrepresentations.

Along with the recent decline in its share price, the group has been plunged into something of a liquidity crisis with various banks indicating a cessation in certain lines of credit and rating agencies downgrading the group’s bonds by 4 notches to “junk”. The Supervisory Board of Steinhoff has been bolstered and has confirmed that “non-core assets” will be sold and that it has received interest from external parties. PWC is conducting an independent review. The chronology of events leading to the current dire position is summarised as follows:

Allegations of impropriety first emerged on 24 August 2017 regarding the proper disclosure of an ongoing legal case with a previous related party – the company rejected this assertion via a SENS announcement. On 8 November 2017, further allegations emerged regarding inappropriate accounting treatment in dealings with a subsidiary. Steinhoff again rejected these allegations via a SENS announcement, specifically stating “Steinhoff´s reporting and investor information regarding all transactions between Steinhoff and GT Global Branding are in line with all IFRS (International Reporting Standard) requirements including internal accounting rules and the Prospectus Directive.” At the time of this announcement we began to investigate the materiality of the statement. This resulted in us placing a discount on core operations in our valuation, as a margin of safety. On 4 December 2017, Steinhoff announced that the group’s results for the year to September 2017 would be released as scheduled on 6 December 2017, but that these would be unaudited. On 6 December, CEO Markus Jooste resigned and the company announced that the group’s results would be released at some point in the future – but no date was specified.

A question that arises is whether valuation or liquidity considerations will determine the ultimate outcome. Based on our best estimate of fair value, we see a share price of R10.00 as reflective of the following metrics and valuation assumptions: core operations are valued at zero non-disclosed off-balance sheet items are estimated at Eur 1.6bn or 24% of the known enterprise value, tax penalties and joint venture settlements of circa R6 – R7 per share. Outside of these assumptions and observations, we valued the group at around R36 on a sum of the parts basis under a low road scenario. Reducing this value by 30% as a partial liquidation discount and deducting circa R7 for tax penalties and settlement issues results in a “fire sale” value of approximately R 18 – R20 which is just below the level where the share settled on the day following the announcement of the CEO’s resignation (6th December). Prices well below that discount a much lower estimate of value for operations and, indeed, reflect the risk premium associated with a potential cash flow and funding crisis. The focus in the days and weeks ahead needs to be on whether the company will be able to manage: its liquidity needs, the full impact of investigative action, a potential lack of open market and credit facilities in order to meet existing debt obligations and the fallout from the reputational damage done. Based on this analysis we do not deem it prudent to lighten positions at the prevailing market price of R6 and would not add to remaining positions until we have greater transparency into the key risks set out above.”